How Quant Mutual Fund Plans for 2026: Insights from Sandeep Tandon

How Quant Mutual Fund Plans for 2026: Insights from Sandeep Tandon

A detailed summary of the insights, philosophy, and outlook shared by Sandeep Tandon, Founder and CIO of Quant Mutual Fund.

The "Risk On" Radar: Deep Dive with Sandeep Tandon

Sandeep Tandon, the veteran investor who began his career during the Harshad Mehta boom of the 90s, recently opened up about his journey, the recent underperformance of Quant Mutual Fund, and his roadmap for 2026 and beyond. A pioneer in the Indian derivatives market and the first employee of IDBI Mutual Fund, Tandon’s approach is defined by predictive analytics and dynamic rebalancing.

Here is a comprehensive breakdown of his views.

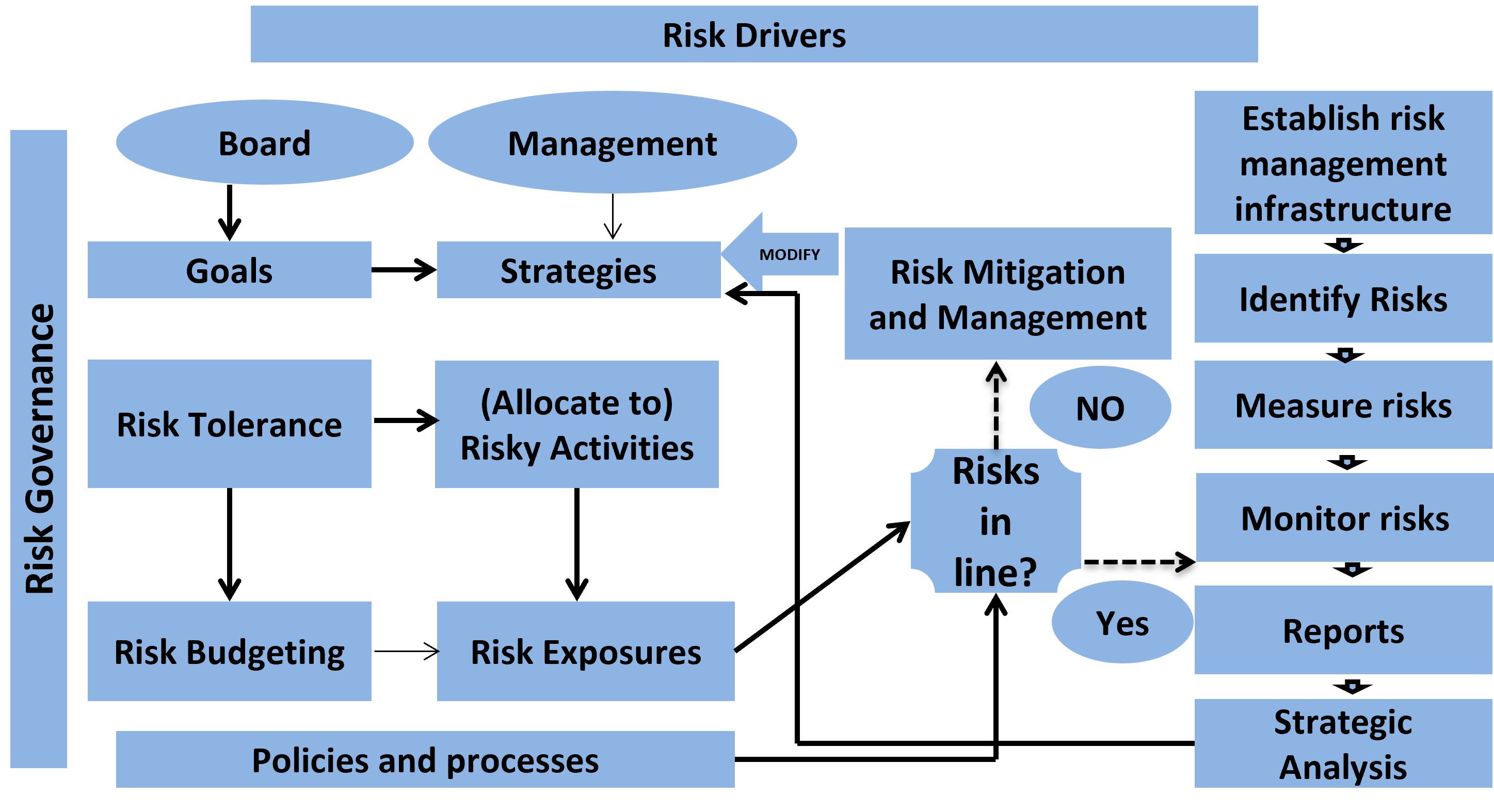

1. The Core Philosophy: Risk Management Over Returns

Tandon emphasizes that Quant is in the "business of risk management; returns are a byproduct".

- Predictive, not Reactive: They do not rely on post-mortem analysis. Instead, they use "predictive analytics," which Tandon describes as a probabilistic science, not a crystal ball.

- The 72% Rule: Historically, their models have a 72% success rate. Tandon openly admits that "28% of the time we are always wrong," but managing the downside during those times is key.

- Risk On vs. Risk Off: The strategy is simple: generate extraordinary alpha during "Risk On" periods and lie low to protect capital during "Risk Off" periods, even if it means temporary underperformance.

2. Addressing the 2024 Underperformance

After stellar performance from 2020–2022, Quant faced headwinds in 2024. Tandon provided a candid "post-mortem" of what went wrong:

- The Diagnosis was Right, The Prescription was Wrong: Quant correctly identified a "risk off" phase starting in July 2024 and moved the portfolio from mid/small caps to large caps and cash. However, the stock selection failed to protect the downside.

- The China Factor: A massive, unexpected stimulus in China caused Foreign Institutional Investors (FIIs) to rotate money out of India. Since FIIs hold large caps, Quant’s large-cap heavy portfolio got "smashed" (falling 20-30%) while midcaps continued to rally.

- Missed "New Age" Rally: Quant did not participate in the rally of new-age tech companies (like Zomato, etc.). Tandon explains they are a data-driven house requiring at least 10 years of historical data to analyze cycles. Without visibility on cash flows or history, they preferred to sit out rather than chase momentum.

- Strategy in Tough Times: Tandon advises that during a period of underperformance, one must "lie low" and control emotions. Trying to aggressively recover losses during a risk-off period often leads to more mistakes.

3. Outlook: 2025, 2026, and Beyond

- Current Status: India is currently in a relative "Risk On" period compared to developed markets. Tandon expects the market to make new highs and deliver double-digit gains relative to December 31, 2024 levels.

- The Next 5 Years (2026-2030): Tandon warns that while we are in a structural bull run, we are entering a "difficult phase of the bull run." Investors should expect volatility and whipsaws.

- Reset Your Expectations: The days of easy 25-30% returns are over. Tandon advises investors to align their expectations to a more realistic 12-13% return to avoid frustration.

- Long-Term Bull Case: He remains extremely constructive on India until 2047, driven by demographic changes. He notes that India will always look "expensive" (like Bombay real estate), but waiting for a correction often leads to regret.

4. Sector Preferences

While stating it is premature to take a 5-year view on specific sectors, Tandon highlighted his current bullish themes:

- Infrastructure: Large infra names.

- Hospitality: Hotels and tourism.

- Financials: NBFCs, Banks, and Insurance (a shift from their previous stance).

- Pharma & Consumption: Selective bets in healthcare and consumption.

5. "Churn" is a Myth; Rebalancing is Key

Tandon rejects the industry term "churn," preferring "dynamic rebalancing."

If rebalancing controls risk and generates alpha, it is a positive feature, not a bug.

However, he acknowledged that impact costs (the cost of executing trades) rose significantly in mid-2024. Consequently, Quant has reduced rotation and focused on increasing portfolio liquidity and utilizing block deals to manage size.

6. The Role of AI and Data

Quant has been using forms of AI (predictive analytics) for 30 years. Tandon views the current AI boom as a tool to multiply outcomes and process data faster, but notes that they are simply doubling down on what they have always done.

7. Skin in the Game

Perhaps the strongest signal of conviction: Sandeep Tandon has 100% of his equity portfolio invested in Quant Mutual Fund schemes.

- He does not invest in personal stocks to avoid behavioral biases.

- He believes that if fund managers and analysts have their own money on the line, their research improves, and they empathize more with investors during drawdowns.

8. Advice to Investors

- Start Early: Investing is "mission critical," not something to do only if you have surplus savings. It should be treated as a habit, not a compulsion.

- Stay the Course: Despite the expected volatility and "expensive" valuations, equity remains the asset class that will outperform all others over the long term.

Summary Takeaway

Sandeep Tandon acknowledges the recent bumps in performance but remains steadfast in his data-driven, risk-focused philosophy. While he predicts a challenging, volatile environment for the next five years, his long-term view on India remains remains steadfastly constructive.

Join the conversation